|

Terms & Conditions

Earnings

10.5% annual dividend

Amount

USD 50,000 (payable by wire or from NRE funds)

Duration

5 years

Currency

Investment will be converted to INR and all dividends will be paid based on the INR value of the investment.

Dividend Terms

Dividends will be paid annually on the anniversary. The dividend will be 10.5 rupees per share of Rs.100. Dividends will be converted to USD based on the exchange rate on the date of the dividend payment. In case the dividends are not paid in a year, the dividend due will accumulate to the capital investment and also earn interest.

Convertible

On any anniversary date, the investor may choose to convert the preference capital and dividends due to equity capital at a rate of Rs.200 per equity share.

Exit Strategy

The preference capital will be returned to the investor on the fifth anniversary along with any dividends due and will be converted to USD based on the prevailing exchange rate on the fifth anniversary. Investor may transfer or sell the investment to another investor.

No Fees |

|

Purpose

To increase the net worth of the company as required by the Securities and Exchange Board of India. To be invested in a portfolio of high quality growth securities.

Investor Benefits

- High Fixed Return through Tax Free Dividends

- Low Risk Participation in India's Growth (see below)

- Currency Appreciation Opportunity vs. US $

- Low Risk Access to Growing Financial Services Sector

India's Growth Advantage

High Growth Rate. The Indian economy is growing at a 5% rate, and is projected to grow at a 7% rate for several years. According to the Asian Development Bank, India's economy is projected to grow more rapidly than China's over the next 5 years.

Privatization. The Indian government is committed to privatize some of their strongest energy, telecommunications and transportation companies in the next 2 years.

Favorable Election Result. The world's largest democracy selected a new government in May. The new technocratic government has the requisite strength to adopt crucial policy changes to support economic development.

Robust Demographic Base. The country has the world's largest population of people under 30. Improved education means India will be an important source of labor in the future.

Low Investor Participation. Savers in India are still learning to invest in the stock market. Foreign investors have only recently started making significant investments in the country.

Risks

Currency Risk. Changes in the value of the Rupee versus other currencies may impact your investment returns.

Market Risk. Changes in the value of the Indian stock market may impact the ability of the company to pay dividends.

Business Risk. Changes in the operational success of the company may impact the ability of the company to pay dividends. |

|

PSSG CAPITAL MANAGEMENT PVT. LTD., FOUNDED FEBRUARY 2007, IS A CLIENTFOCUSED ASSET MANAGEMENT COMPANY. PSSG PROVIDES ADVISORY SERVICES AND PORTFOLIO MANAGEMENT TO CLIENTS FOR A COMPETITIVE FEE. PSSG INVESTS IN INDIAN GROWTH-ORIENTED COMPANIES SELLING AT A DISCOUNT TO THEIR REAL VALUE.

Directors

C.N. Pantulu, C.A. 50 years experience

V.S. Sastry, C.A. 45 years experience

G.N. Sarma 40 years experience

Peter K. Schneeberger 12 years experience

Assets Under Management

2008: 10,547 (Rs. '000s)

2009: 5,918 (Rs. '000s)

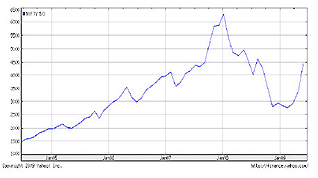

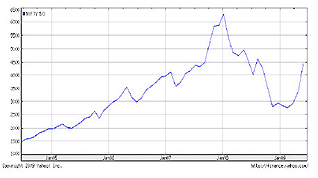

Nifty Index 5-Year Change

Now is the time to accept this unique opportunity to become involved in India. Review the trend of the NSE Nifty 50 from 2004 to the present. Note the growth between 2004 and 2008 before the global financial crisis drove the Nifty 50 down more than 50%.

Contact

PSSG Capital Management, 9-42-4, Balajinagar, Siripuram, Visakhapatnam 530003

phone +91-891-270-2737,

fax +91-891-270-2737

email: pks@pssgcapital.com |

|